As many residents already know, the Board of Directors (the "Board") of Fort Bend County Municipal Utility District No. 142 (the "District") has called a bond authorization election for May 4th, 2019. As part of the ongoing conversation surrounding the election and the Board's goals for the future of the District, we have put together some answers to frequently asked questions regarding the District and the election.

What is the District?

The District is responsible for providing water, sanitary sewer, and drainage infrastructure, as well as park and recreational facilities, to approximately 13,000 residents in over 3,200 homes within the approximately 1,245 acres of the District, including over 25 acres of commercial property. The District is a Municipal Utility District and political subdivision of the State of Texas created on July 25, 2003, by the Texas Commission on Environmental Quality.

In order to provide water and sanitary sewer service to the District, the District currently operates and maintains: (A) 2 water plants, including 2 water wells; (B) 2 temporary wastewater treatment plants; (C) 3 lift stations; (D) 1 storm water pump station; (E) approximately 260,000 linear feet (or approximately 49 miles) of waterlines; and (F) 260,000 linear feet (or approximately 49 miles) of sanitary sewer lines.

What is the election?

The District is requesting authorization from the voters of the District to issue bonds in several increments over time, as needed, to fund the construction of a permanent wastewater treatment plant and the required maintenance of all District water, sanitary sewer, and drainage infrastructure over the next 30 years.

Proposition A – The issuance of up to $79,500,000 of water, sanitary sewer, and drainage facilities bonds.

The District is also requesting authorization from the voters of the District to issue bonds to fund the construction of desired park and recreational facilities in the District.

Proposition B – The issuance of up to $7,000,000 of park and recreational facilities bonds.

What is a bond authorization?

Bond authorization means the District has the option to issue bonds, it does not require the District to issue any bonds. An authorization is similar to a credit line, a sum of money available when the District needs to use it.

If authorized, the District will issue bonds supported by debt service taxes on an incremental schedule that is consistent with the useful life of the projects and facilities to be funded. Such bonds may only be issued with the approval of the Texas Commission on Environmental Quality and the Texas Attorney General after review pursuant to strict rules and regulations, including financial feasibility requirements.

Each bond issue will be evaluated by the Board against other funding options to determine the best available option for any given project(s). Any bonds will be sold at public meetings and pursuant to a competitive bidding process overseen by the Board designed to minimize interest costs to the District.

What will it be used for?

The authorization for water, sanitary sewer, and drainage facilities bonds will be used to finance (A) the construction of a 1,200,000 gallon Permanent Wastewater Treatment Plant and (B) the maintenance, rehabilitation, and replacement of portions of the District's water, sanitary sewer, and drainage infrastructure as they age.

The immediate need is for a new Permanent Wastewater Treatment Plant to serve the District. Building the Permanent Wastewater Treatment Plant will allow the District to stop making $780,000 in lease payments each year for the current temporary wastewater treatment plants, all of which will be replaced by the Permanent Wastewater Treatment Plant. The existing "package" plants are temporary in nature. Rather than entering into new leases, requiring new temporary facilities, the District will construct a permanent plant with concrete walls which will require little to no structural maintenance.

Further, as infrastructure ages, it requires maintenance, rehabilitation, and, sometimes, replacement as part of its lifecycle. Municipal Utility Districts were originally created to eventually be annexed by a neighboring city, after which the city would pay for the costs of operating, maintaining, and repairing all District facilities. Annexation of the District by the City of Houston is very unlikely, so the District must prepare to fund all necessary costs of maintenance of the water, sanitary sewer, and drainage facilities required to serve its residents.

The District intends to issue bonds only as necessary over 30 years pursuant to a capital improvement plan reviewed and approved by the Board, as recommended by the District's engineer. On average, infrastructure lasts about 30-40 years with optimal maintenance and operations. Proactive maintenance allowed by the authorization of the bonds will enable the District to maximize the life of its water, sanitary sewer, and drainage infrastructure.

The authorization for park and recreational facilities bonds will be used to finance various park and recreational sites and facilities in the District desired by the residents of the District, including community parks, small neighborhood parks, passive and natural amenities, and an integrated community trails system. The District is limited by state law to the issuance of park and recreational facilities bonds in amount that does not exceed 1% of its assessed valuation.

The Board has received input from many residents of the District about desired park and recreational improvements. The Board encourages any additional feedback about park and recreational facilities in the District.

How will the authorization affect our taxes?

The Board does not expect any increase in the District's total tax rate in the next 10 years. This projection is based on the following factors:

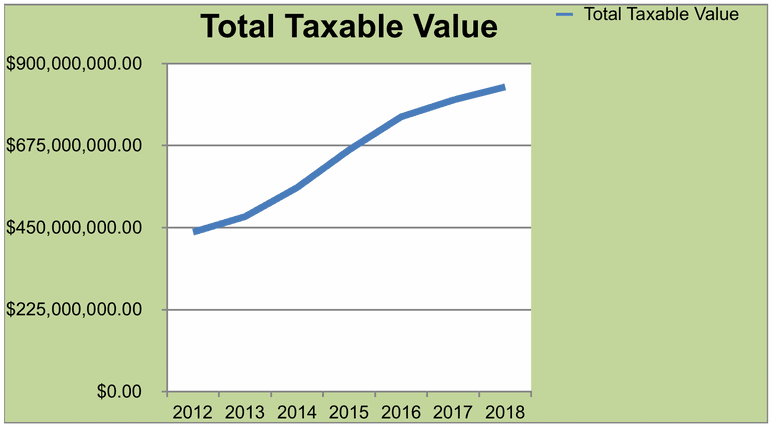

- the projected growth in assessed valuation as provided by the developers of the district, including the planned single-family homes and commercial improvements on currently undeveloped land located within the district;

- the projected debt service requirements of the future bonds to be issued to finance the development of such property; and

- the projected debt service requirements of the future bonds to be issued to finance the capital improvement projects anticipated during such 10 year period, including the construction of the permanent wastewater treatment plant, if such bonds are authorized.

The alternative to authorizing the bonds is to fund all necessary future capital improvements on a "pay as you go" basis using substantial increases in maintenance tax rates and/or water and sanitary sewer rates. For more detailed information on "pay as you go", visit the Long Term Plan Article. Funding the necessary capital improvement projects with maintenance taxes or water and sewer rates would put the entire financial burden on current residents and create a delay in the time required to collect the funds necessary to complete the projects.

Authorizing the District to issue the bonds will allow the Board to spread the costs of the necessary projects over several years and avoid significant increases in maintenance tax rates and/or water and sanitary sewer rates required by a "pay as you go" approach. This allows the costs of the required projects to be shared by both current and future users of the District's system, including commercial property owners. With the authorization and issuance of the bonds, it is not expected that an increase in the District's maintenance tax will be required since maintenance tax revenues are not pledged to the payment of the bonds.

How are my District taxes determined?

The District levies a total tax rate each year with two components:

- A debt service tax rate, the proceeds of which may only be used to make payments on the District's outstanding bonds; and

- A maintenance and operations tax rate (often referred to as "M&O"), the proceeds of which are deposited in the District's General Fund and used, together with water and sewer revenue, to pay operating and maintenance expenses of the District.

Each year, after the assessed valuation of all property located in the District is certified by the Fort Bend Central Appraisal District, the Board levies the debt service tax rate necessary to pay the debt service on outstanding bonds and the maintenance and operations tax rate necessary to pay all operating expenses of the district annual budget and maintain adequate reserves in its General Fund for emergencies or other unexpected expenses.

How does the District manage taxpayer dollars?

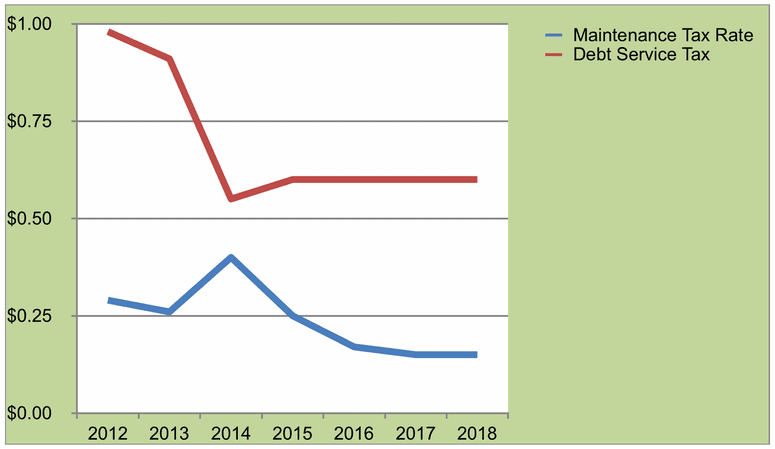

The Board has lowered the District's total tax rate by 40.9% since 2012 and accumulated a substantial rainy day reserve. As a result of this prudent financial management, the District has earned an A2 rating from Moody's.

Both components of the District's tax rate have been reduced significantly since 2012, with the District's total tax rate going from $1.27 down to $0.75.

Continued development and growth in the District have broadened the District's tax base, allowing the Board to reduce tax rates.

Where can I vote?

Early voting begins on April 22, 2019 and Election Day is Saturday, May 4, 2019. The District is holding the election jointly with Fort Bend County. More information regarding Fort Bend County polling locations and voting hours can be found here: https://www.fortbendcountytx.gov/government/departments/county-services/elections-voter-registration/vote-by/in-person-ballot.

I have more questions…

Good! The goal is for the residents to have all the information at their disposal when voting approaches.

The District hosted an Open House on April 18th, 2019, for residents of the District to learn more about the election. The Board has provided additional information and exhibits, which can be found in the Open House Summary Article. The Open House gave residents an opportunity to ask the District's consultants and the Directors any questions about the District and the election.

Additional questions can be fielded through the Contact Us form on the district website.